Another round of United States Mint sales figures are out and they show updated totals for the three 50th Anniversary 2014 Kennedy Half-Dollar products and the more recently issued 2014 American $1 Coin and Currency Set.

Weekly gains for the Kennedy half-dollar products returned to about where they were prior to the sales spike when the Mint lifted household ordering limits on Nov. 17, although the cheaper clad set is doing better at hanging on to stronger sales.

As for the latest weekly sales of the 2014 Native American $1 Coin and Currency Set, they really show about one day’s worth of gains because the Mint temporarily stopped selling them later on Nov. 24 when it ran out of stock.

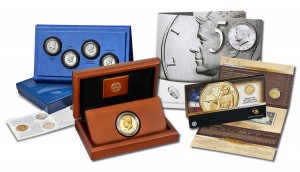

Directly below is a table of weekly and total sales for the three 50th Anniversary Kennedy products that feature 7 coins in varying finishes and compositions and for the coin and currency set which includes an uncirculated dollar bill and a unique enhanced uncirculated Native American $1 Coin (see new photos of the set).

| Unit Change (Nov 3-9) |

Unit Change (Nov 10-16) |

Unit Change (Nov 17-23) |

Unit Change (Nov 24-30) |

Latest Sales |

|

| 2014 American $1 Coin and Currency Set | N/A | N/A | 9,720 | 4,353 | 14,073 |

| Kennedy Half-Dollar Silver Coin Collection | 12,655 | 6,770 | 21,719 | 6,343 | 172,634 |

| Kennedy Half-Dollar Gold Proof Coin | 493 | 312 | 442 | 339 | 67,640 |

| Kennedy Half-Dollar Uncirculated Clad Coin Set | 4,414 | 2,706 | 16,896 | 4,676 | 170,500 |

Based on their limits:

- the American $1 Coin and Currency Set is at 28.1% of its maximum 50,000;

- the Kennedy silver coin collection is at 76.7% of its maximum 225,000; and

- the Kennedy clad set is at 85.3% of its maximum 200,000 sales.

United States Mint collector products are available at www.usmint.gov/catalog, or by calling 1-800-USA-MINT (872-6468).

Getting closer to the 180K on the silver and the 70K on the gold…also the end of the year. Lets see if they end it all at the end of December.

the sales figure on november 23 report. yours and u s mint were not tally or reverse on the clad set and silver set. which one is correct?.

Jim, thanks for pointing that out. We need to update sales articles published last week.

The weekly increases and latest sales are correctly shown above. The U.S. Mint in an email on Nov. 24 (and before its full sales report was available) listed sales of the silver set at 165,824, which we quickly reported. As it turns out, that total was clad set sales as of the 23rd. The silver set actually had sales of 166,291 by the 23rd, which we then incorrectly reported as the total for the clad set.

Jp,

Your idea makes lots of sense.

The Mint already tried twice, by lifting the order limit & by lowering the mintage by 75,000 to try to give a “jolt” to sales but did not quite work…Makes little sense to make another 45,000 since sales will be between 4,000 & 5,000 weekly from now on. Maybe by cutting it off at 180,000, which have already been made is the thing to do. Similar situation with the gold coin. Let’s honor the anniversary year by ending the Kennedy halves!

Eddie,

I agree … Lets end the year right by ending the Kennedy coins series. What say all of you?

What I hope the Mint learns from this release is the balance that must be struck (no pun intended) between the collector and the dealers (the orders for collections and the ones for the secondary market). A Mintage release of the Kennedy Gold at 50k, the Silver at 200k and the Clad at 150k would have been optimum. For larger issues a household limit of 10 is optimum. For a smaller mintage 5 is optimum (i.e. Gold 20th Ann Eagle set). This assures a sellout and creates demand in the secondary market (works well for both the collector and dealer).… Read more »